Economic crime continued to be a major focus of Eurojust’s casework in 2022, covering investigations into a wide range of offences including swindling and fraud, money laundering, corruption and crimes against the financial interests of the European Union.

Operational support to swindling and fraud cases

As for the past 3 years, swindling and fraud remained the top crime type addressed by Eurojust in 2022, with 3 683 cases handled. In addition to more than 1 500 new cases, more than 2 000 ongoing cases from previous years were coordinated through the Agency. Eurojust dealt with more than 500 extra swindling and fraud cases in 2022 compared to 2021.

During 2022, a large number of economic crime related coordination meetings (115) and JITs (72) were facilitated by Eurojust, as well as 6 action days.

Investment fraud

Since the start of the COVID-19 pandemic, criminals have increasingly defrauded victims via online trading platforms. This trend continued in 2022 as illustrated by the high number of investment fraud cases registered at Eurojust, and the rise in the number of victims impacted throughout the European Union.

Multilateral investment fraud cases bring particular challenges and an increased need for judicial cooperation via Eurojust. The Agency can assist countries on legal issues concerning cross-border cases, including: centralising proceedings at national and international level; avoiding possible conflicts of jurisdiction; and prioritising the prosecution of common suspects.

Missing Trader Intra-Community fraud

In 2022, EUROJUST was co-leader for the first time, together with Sweden and Europol, in an EMPACT Operational Activity on Missing Trader Intra-Community (MTIC) fraud. Participants in this specialist group include 13 Member States, as well as Europol, the European Anti-Fraud Office (OLAF), the European Commission’s DG Justice, with the European Public Prosecutor’s Office (EPPO) as an observer. MTIC fraud is detrimental to EU and national budgets, as well as complex to successfully investigate, prosecute and convict. Tackling this type of fraud is one of the aims of the EMPACT 2022–2025 priority on fraud, economic and financial crimes.

Fraud against NextGenerationEU recovery funds

Launched in 2021 and extended in 2022, operation SENTINEL is an EU-wide operation aimed at ensuring the lawful use of the NextGenerationEU recovery funds by detecting, investigating and prosecuting cross-border criminal activities such as fraud and money laundering. The operation was launched by Europol and involves Eurojust, EPPO, OLAF and 20 EU Member States. It aims to ensure that the EUR 806.9 billion budget is used to strengthen the EU economy rather than ending up in criminals’ bank accounts. Eurojust is dedicated to fully supporting this operation, particularly should cases emerge where the EPPO or competent national authorities seek the Agency’s assistance.

Takedown of infrastructure of call centres involved in online investment fraud responsible for losses of at least EUR 20 million

Crime: An international OCG commits online investment fraud by convincing victims online and by telephone to make payments to invest in cryptocurrencies. The OCG uses a large-scale IT infrastructure that includes tens of virtual servers, connected by computers in call centres.

The perpetrators install remote access programmes that allow them to illegally access the victims’ computers and steal their banking credentials. More than 30 000 people from around 71 countries (with roughly 522 victims registered in Estonia alone) are defrauded of at least EUR 20 million.

Action: Authorities in Finland, the Netherlands, Latvia, France, Germany and Ukraine support a joint operation on 21 April 2022 to disrupt and paralyse the criminal activities of the OCG.

Result: More than 50 servers are seized (taken down and data copied), in Finland, the Netherlands, Latvia, France and Germany.

Eurojust's Role: Eurojust facilitates judicial cooperation by setting up and funding a JIT. Two coordination meetings are organised to coordinate the national investigations and prepare for the action day. To support the action day, Eurojust sets up a coordination centre to enable rapid cooperation between the involved judicial authorities.

Eurojust supports action against large-scale VAT fraud to the EU

Crime: An OCG regularly smuggles large quantities of cigarettes produced in the United Arab Emirates to Hungary, committing large-scale VAT fraud. The estimated damage caused by the tax evasion to the European Union budget amounts to over EUR 8 750 000.

Action: On 16 August 2022, a joint action day is supported by Eurojust and Europol, during which one suspect is arrested. International and European Arrest Warrants are issued against three more suspects still at large.

Result: Authorities in Hungary, Austria, the Czech Republic and Poland dismantle the criminal network. Over EUR 750 000 in several currencies, 7 high-value cars and 49 very high-value wristwatches are seized in Hungary.

Eurojust's Role: The Agency actively facilitates cross-border judicial cooperation between the national authorities involved, including the execution of European Investigation Orders (EIOs) and the organisation of the joint action day.

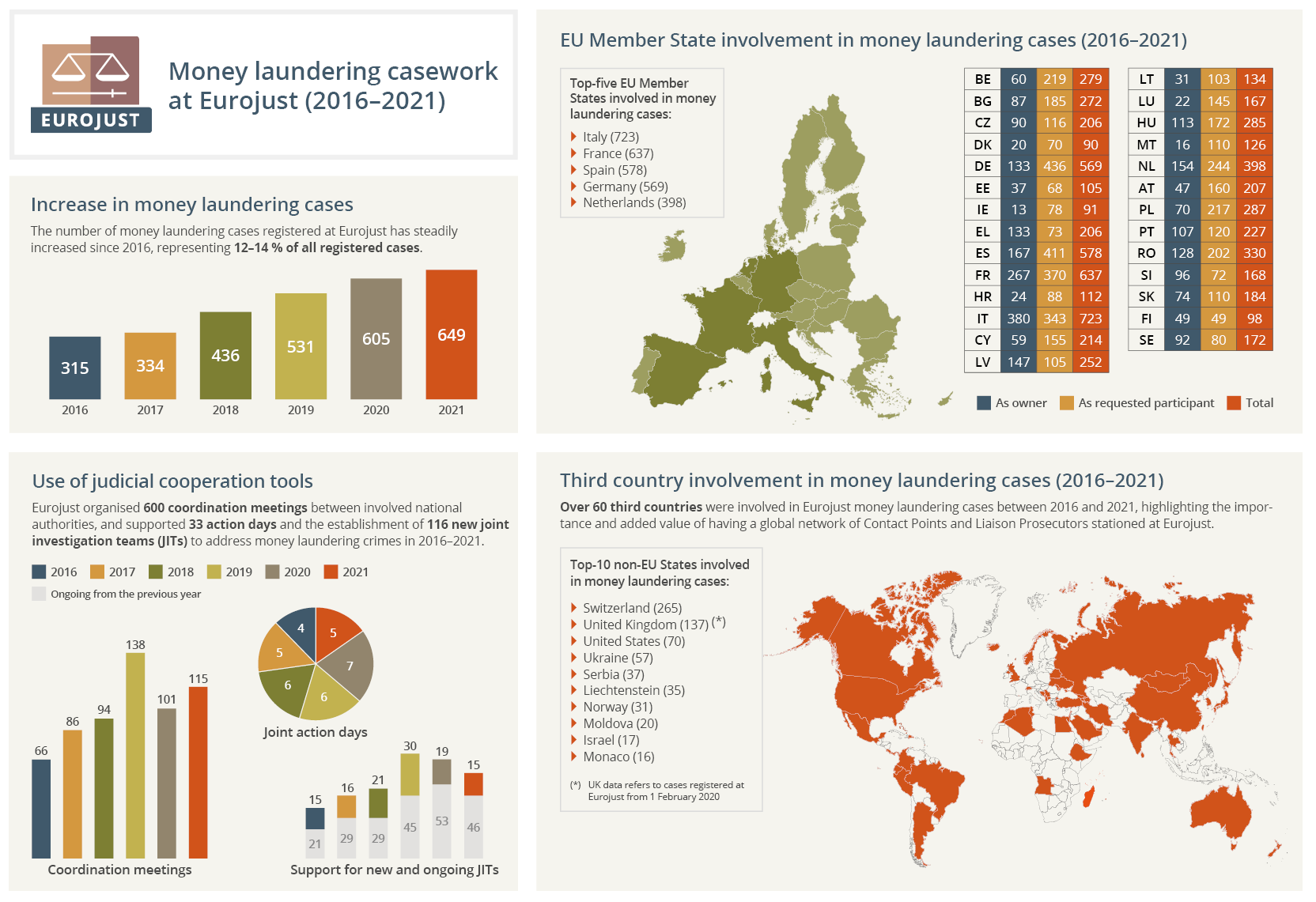

Operational support to money laundering cases

As in previous years, money laundering remained among the top three crime types addressed by the Agency in 2022. Eurojust saw an increase in the number of cases, JITs, coordination meetings and actions days compared to the previous year.

Eurojust's first money laundering report

In October 2022, Eurojust published its first dedicated Report on Money Laundering. The report aims to support national authorities dealing with cross-border money laundering cases by providing an overview of the legal and practical challenges, as well as solutions, including the use of Eurojust's judicial cooperation tools.

According to the report, almost 3 000 cross-border money laundering cases have been registered at Eurojust during the past 6 years. Since 2016, the number of cases brought to the Agency has been steadily rising. Given this large number of cases, the report focuses on certain selected topics: (i) predicate offence; (ii) complex money laundering schemes; (iii) financial and banking information; (iv) asset recovery; (v) cooperation with third countries; (vi) cooperation with the European Public Prosecutor’s Office; (vii) potential conflicts of jurisdiction and ne bis in idem issues; and (viii) spontaneous exchange of information.

All EU Member States have been involved in international money laundering cases brought to Eurojust during the past six years, with Italy, France, Spain, Germany and the Netherlands dealing with the largest number of cases. Over 60 third countries have also participated in such cases, with Switzerland, the United Kingdom, the United States and Ukraine representing the non-EU states most involved.

Based on Eurojust’s casework during the past six years, the report identifies the most relevant legal and practical challenges in this area, as well as the most relevant best practices for national authorities to learn from.

Money laundering legislative package

Throughout 2022, the legislative procedure for the package of four proposals to strengthen the European Union’s anti-money laundering and counter the financing of terrorism was ongoing. The aim of the package is to improve the detection of suspicious transactions and activities, and to close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system.

Several issues addressed by these proposals are analysed in Eurojust’s Report on Money Laundering. These include the identification of beneficial ownership of criminal assets, difficulties linked with the misuse of cryptocurrencies, and the role of asset recovery offices.

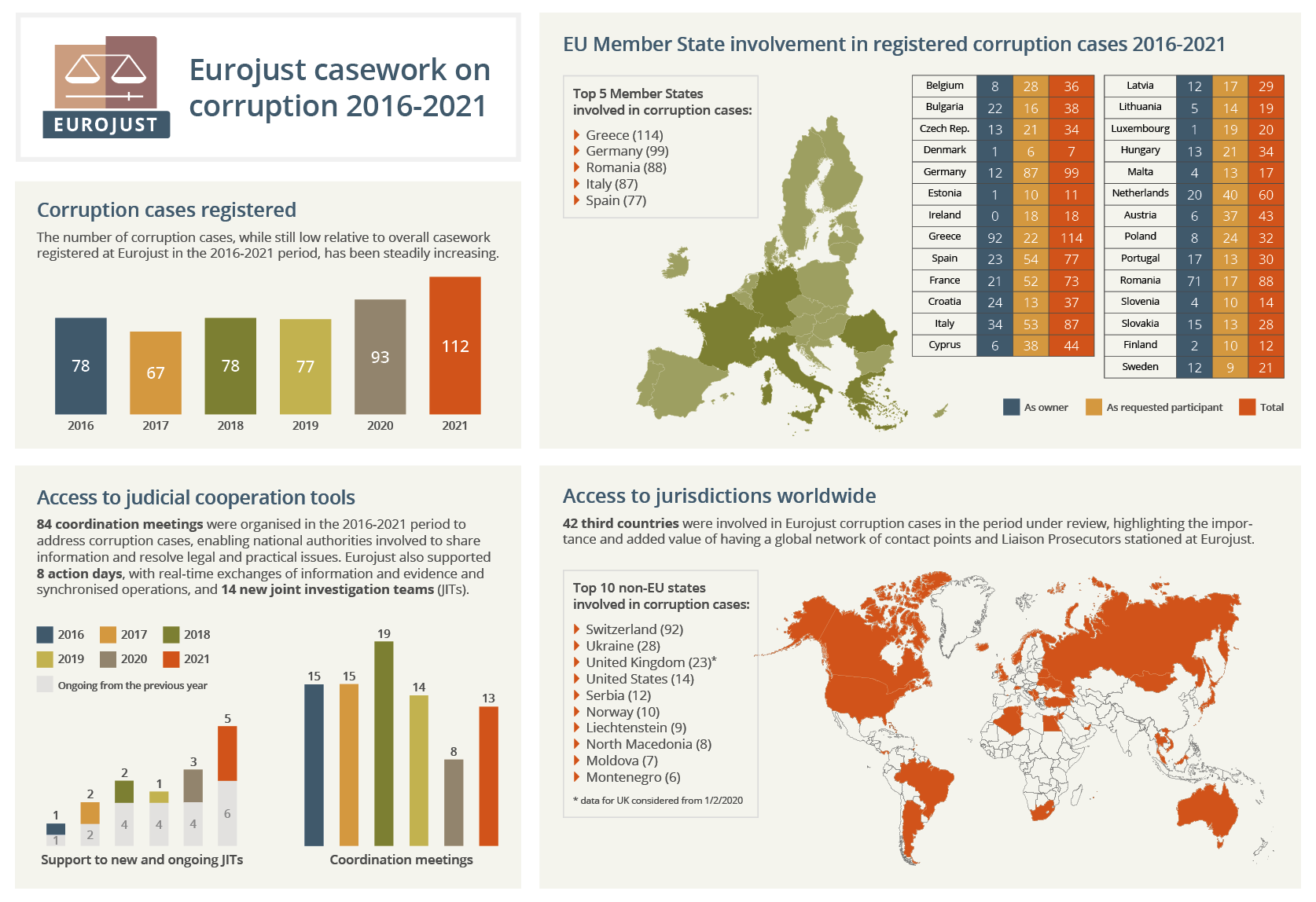

Operational support to corruption cases

In 2022, Eurojust supported 87 new corruption cases.

The Agency continued to provide legal, operational and logistical support to 10 JITs, while also facilitating 14 coordination meetings and 2 successful action days.

Eurojust's first corruption report

In May 2022, Eurojust published its first dedicated publication in the corruption field: Eurojust’s Casework on Corruption: 2016–2021 Insights. During the report’s reference period, more than 500 corruption cases were registered at Eurojust.

The report presents key findings based on Eurojust’s corruption casework and expertise built up over the years. It provides support to national authorities dealing with cross-border corruption cases by analysing challenges and proposing solutions.

Eurojust is uniquely equipped to address the specific challenges of corruption cases through its judicial cooperation tools. Coordination through Eurojust has led to tangible results, including seizures, confiscations, arrests and convictions in complex cross-border corruption investigations and prosecutions worldwide.

The top five Member States involved in corruption cases registered at Eurojust are Greece, Germany, Romania, Italy and Spain. Third countries also play a key role in Eurojust's corruption casework, with 42 third countries involved between 2016 and 2021.

Operational support to PIF cases

Protection of the financial interests of the European Union (PIF) crimes are crimes against the financial interests of the European Union, as defined by Directive 2017/1371 (PIF Directive). During 2022, Eurojust dealt with a slightly higher number of PIF crime cases compared to 2021.

The Agency handled more than 200 cases and supported 4 investigation teams, 19 coordination meetings and 2 action days.

Despite the EPPO starting operations in 2021, Eurojust is still competent in supporting PIF crime cases involving EU Member States not participating in the EPPO, and third countries, also on request of the EPPO. Moreover, the Agency is also competent in supporting all Member States (whether participating in the EPPO or not) in cross-border judicial cooperation on PIF-related crimes that fall outside the EPPO competence.

In March 2022, Eurojust provided input based on its PIF crime casework to the European Commission’s study to support an implementation report on the fight against fraud to the Union's financial interests by means of criminal law. The study assesses the transposition and implementation of the PIF Directive and gathers statistics on relevant criminal offences. The second implementation report of the PIF Directive, based on this study, was published in September 2022.